Stocks that pay a dividend while you wait for capital appreciation.

Paid to wait works as a starting point for investment research: presenting potential opportunities and helping readers to do further research on stocks that fit into their own (dividend) investment strategy.

A | Hexpol. Dividend yield 4.7%.

B | Aalberts. Dividend yield 3.6%

A | Hexpol

🔑 A track record of profitable growth, an attractive valuation and dividend, strong balance sheet, active consolidator.

📉 High exposure to automotive industry, not strong enough for China?

Listing: Stockholm, Sweden.

Hexpol in a nutshell: Describing Hexpol understandably is a challenging task.

Hexpol has a revenue of SEK 20.4 billion ($2.1 billion) and 5000 employees.

Hexpol has two distinct business units. Hexpol Compounding (93% of revenue) manufactures and supplies rubber, thermoplastic elastomer and thermoplastic compounds. Hexpol develops proprietary formulas and often develops them together with the customer.

Hexpol Engineered Products (7% of revenue) consists two units. Gislaved Gummi manufactures gaskets for plate heat exchangers and Stellana makes polyurethane wheels and rubber tires for special applications such as forklift trucks.

Hexpol serves a wide variety of industries, however automotive is its largest end market.

Founded: 1893. Hexpol became an independent listed company in 2008 by a spin-off from Hexagon.

Investment thesis in brief: Hexpol shares are attractively valued in relation to the quality of the business. Furthermore, the stock trades below its historical averages.

Hexpol has delivered high single-digit revenue and earnings growth together with low leverage and high returns on capital.

Hexpol’s competitive advantage is based on global scale and closeness to the customers in most continents. Its reason to exist is to create the best compound for the customer out of raw materials supplied by various suppliers.

Once it has developed a compound together with a customer, there’s a high level of lock-in. Its decentralized operational model gives flexibility and accountability to local units. These key factors are further enforced by wide product and service offering, tehcnical expertise and focus on efficiency.

Hexpol is one of the leading companies in a fragmented industry where it can continue to grow by consolidation.

The largest downside risk lies in the company’s exposure to automotive sector and small share of the business coming out of Asia. The company could have overearned in the past couple of years, however its earnings power should have increased too.

Share price / Market cap: SEK 87 / SEK 30 billion ($3 billion).

Closest peers: According to Hexpol its main competitors are AirBoss, Teknor Apex, Dynamix, PTE, Multibase, GLS, Kraiburg, A. Schulman and Washington Penn.

Bull case 🐂

Track record of profitable growth: Hexpol has delivered attractive revenue growth in both 5 and 10 year timeframes, although its 5-year CAGR (5.3%) is lower than 10-year. Hexpol has grown to a size that it’s harder to move a needle with acquisitions.

High returns on capital: According to QuickFS Hexpol has 10-year median return on equity of 20% and ROIC of 17%. Although Hexpol’s business appears commodity-like on the surface, returns on capital gives a hint that the company has a competitive advantage or favorable environment.

Acquisition driven growth: Hexpol does 1-4 acquisitions per year.

Hexpol’s modus operandi appears to be acquisition of culturally compatible companies in new geographies or adjacencies and for a purpose of consolidation. Then, Hexpol slowly streamlines and integrates the acquired companies and finally converts companies under Hexpol brand.

The latest acquisition of Hexpol took place in Turkey. Hexpol acquired Kabkom with revenue of €30 million for €54 million.

“Kabkom is the market leader in HFFR compounds for the cable industry in Turkey.”

Strong balance sheet: At the end of 2024 net debt to EBITDA ratio was 0.59x. Considering the low leverage, the high ROE looks even better.

Future growth: The structural growth for Hexpol is likely to come from acquisitions, but there is an interesting detail regarding automotive and likely applies to other industries as well to smaller extent.

Hexpol believes that the use of polymers will increase in the automotive industry. When EVs are designed polymers have an opportunity to replace sheet metal and metal with polymers because of its lower weight, cost and environmental impact.

Ownership structure: Melker Schörling Ab holds 25% of the shares and 46% of the voting power. Melker Schörling, named after the man who was a CEO of various Swedish industrial companies, is an active investor which has meaninful stakes in multiple companies listed in Stockholm.

Valuation💰

Historical valuation: Hexpol’s shares are trading couple of turns lower than its historical averages.

Earnings per share: 10-year average is approximately SEK 5. In 2023 and 2024 Hexpol delivered EPS of SEK 7.33 and SEK 6.45.

In the period of 2021-2024 the EPS has been around SEK 6-7.

In the preceding period of 2015-2020 the EPS was around SEK 4.

Is the earnings power of Hexpol structurally 50% higher?

Compared to 2020, the revenue is 52% higher, gross margin is on a similar level but the operating margin is ~2 %-points higher.

From this perspective, the key question is, if the company is able to maintain its volumes to protect revenue and efficiency?

Hexpol’s selling prices are negotiated very frequently due to the changes in raw material pricing. This could indicate that the nature of its business is somewhat similar to specialty chemical distributors - i.e. revenue is quite variable due to the changes in raw material prices.

For 2025 analysts are expecting approximately 5% decline in revenue and earnings per share. The average target price is SEK 102 by five analysts.

“Sales prices were sequentially stable with no big variations in price for major raw materials.” -Q1 earnings call

P/E-multiple: The average 5- and 10-year forward P/E-multiples for Hexpol are 15.3x and 16.8x. Currently Hexpol trades at a forward multiple of 13x.

A peer spotlight: A peer comparison could be done against another Swedish company Trelleborg, which is significantly larger company and a manufacturer of polymer solutions.

Trelleborg’s historical growth, returns on capital and margins are all lower than Hexpol’s, with a similar balance sheet profile.

Trelleborg is valued at a P/E of 22 and at EV/EBIT 14.

The size and type of the two businesses vary, so no direct comparison should be made. However, the comparison supports the thesis of Hexpol’s potential undervaluation.

Trelleborg’s business is more diversified geographically and by end market. Its business performed just slightly better in Q1 with organic revenue growth of 1% and EPS staying flat.

Dividend: The dividend policy of the company is to distribute 40-60% of the net profits to shareholders. The most recent dividend payment was SEK 4.2.

Dividend yield of 4.7%. Payout ratio 65%.

The dividend has grown at 12.8% CAGR for the past 5 years.

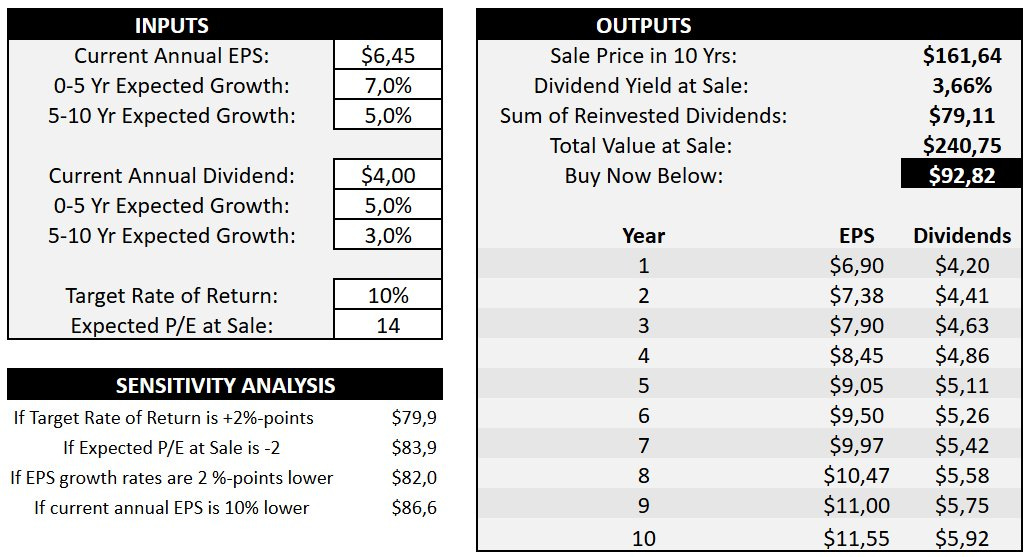

Fair value: By placing the historical figures to a simple fair value calculator we arrive to a fair value of SEK 93. Purchasing the shares closer to SEK 80 would give better margin of safety, as highlighted in the sensitivity analysis.

Bear case 🐻

A cyclical entering to downturn: It is possible that Hexpol has enjoyed favorable market dynamics for the past years and is about to enter a tougher period.

High exposure to automotive: 38% of Hexpol’s revenue comes from automotive. Although Hexpol does not sell directly to the car manufacturers, Chinese car manufacturers are becoming or already have become the leaders in the automotive industry. Only 6% of Hexpol’s sales comes from Asia.

This equation can mean that its “end” customers are slowly losing and therefore Hexpol could be losing with them. However, automotive system suppliers, such as interior manufacturer Novem, are rather international.

Some Chinese manufacturers are setting up production in Europe and the U.S., but are their suppliers following suit?

It appears that Hexpol pursued to penetrate Chinese market already over 15 years ago. Judging based on the share of revenue, the effort has not been successful.

In the annual report of 2010, China is mentioned 89 times, highlighting growth and investments, where as in the annual report of 2024 China is mentioned 18 times.

In the annual report of 2024, Hexpol says it has a profitable niche position in China in the rubber compounding product area, which is one of the four product areas. In the other product areas it has a weak or no position. This suggests that Hexpol has not been able to compete against local players in China.

Judging based on the number of employees in China, and overall in Asia, the region appears to be more source of production than a market for Hexpol.

In Europe, however, automotive production declined significantly by 7 percent year-on-year to around 4.2 million units. The trend in North America was similar, with a decline of 5 percent to 3.8 million vehicles. China, by contrast, recorded an increase of more than 11 percent to 6.9 million units. Weighted for regional sales of the Automotive group sector, global automotive production was therefore down 3 percent. -Continental AG, Q1

Position in the value chain: It is a little bit challenging to understand Hexpol’s position in the value chain holistically.

Some of the Hexpol’s competitors are part of the largest chemical companies. Above mentioned Multibase is owned by DuPont and A. Schulman was acquired by LyondellBasell in 2018.

The following snapshot from Hexpol’s sales brochure summarizes Hexpol’s role rather well. It is an integrator of polymers and rubbers from different raw material producers in order to create the best combination for an industrial customer.

Summary

In many ways Hexpol is attractively valued but it’s not a clear bargain. Due to the weakness in automotive and construction there’s a likelihood that Hexpol could be still trending lower. A drawdown to SEK 80 would likely be an attractive point to open or add to a position. Nevertheless, Hexpol appears a solid candidate as a long-term quality investment with a growing dividend.

Appendix

Capital markets day upcoming on 4th of November.

My twitter handles

🇬🇧 English: @paidwait

🇫🇮 Finnish: @anttisleinonen

B | Aalberts

I wrote an update on a Dutch serial aquirer Aalberts on Seeking Alpha. Aalberts is one of the cheapest stocks among HVAC-companies, although performing nearly as well as the average. Aalberts has a good track record of profitable growth while it’s tapping into several megatrends.

Furthermore, its sales and earnings are subdued by exceptional items (e.g. closure of Russian operations). A turnaround of construction in France and Germany would give the business a big boost. Meanwhile, it continues constant efforts for operational efficiency and acquisitions.